Weak NBFIs in Bangladesh barred from paying dividend

Stocks of non-bank financial institutions (NBFI) dropped by about 1.5 per cent yesterday, a day after the central bank’s banned them from providing dividends of more than 15 per cent. With a number of non-bank financial institutions (NBFIs) suffering from severe cash crunch, the Bangladesh Bank (BB), central bank of the country yesterday barred financial institutions with lower capital and higher default loans from paying dividends, reports the Daily Star.

The move aims at helping struggling NBFIs as they might face further difficulties in the coming months as non-performing loans are expected to escalate.

The Bangladesh Bank said the NBFIs, which have a capital adequacy ratio (CAR) of less than 10 per cent and more than 10 per cent default loans, will not be able to declare any dividend and a 15 per cent cap on dividend for 2020 was set on the healthier NBFIs.

Arif Khan, Chief Executive and Managing Director of IDLC Finance, told the Daily Star that the BB decision would bring about positive impact for the financial industry.

“It appears that the Bangladesh Bank has issued the directive so that NBFIs can avoid a stress situation in the event of a rise in classified loans in the future,” he said.

The NBFIs that have low-cash flow will not see funds falling because of dividend non-payment, he said.

Similar measures have been suggested for banks too.

On February 7, the central bank declared a dividend policy for banks for 2020, allowing them to reward their shareholders based on the strength of the capital base because of the persisting pandemic.

Banks, which have a stronger capital base, will be allowed to provide higher dividend in the form of cash and stock compared to the weak lenders.

The central bank said financial institutions with more than 10 per cent default loans would need to get approval to announce dividends.

This is the first time in recent years the BB gave the directive and it came at a time when a number of NBFIs are facing capital shortage and high classified loans because of scams.

Bangladesh has 36 NBFIs, and at least 10 of them are struggling to pay back depositors money despite maturity.

As of December 2020, the CAR of six NBFIs was less than the minimum required level of 10 per cent. Thirteen had more than 10 per cent of default loans.

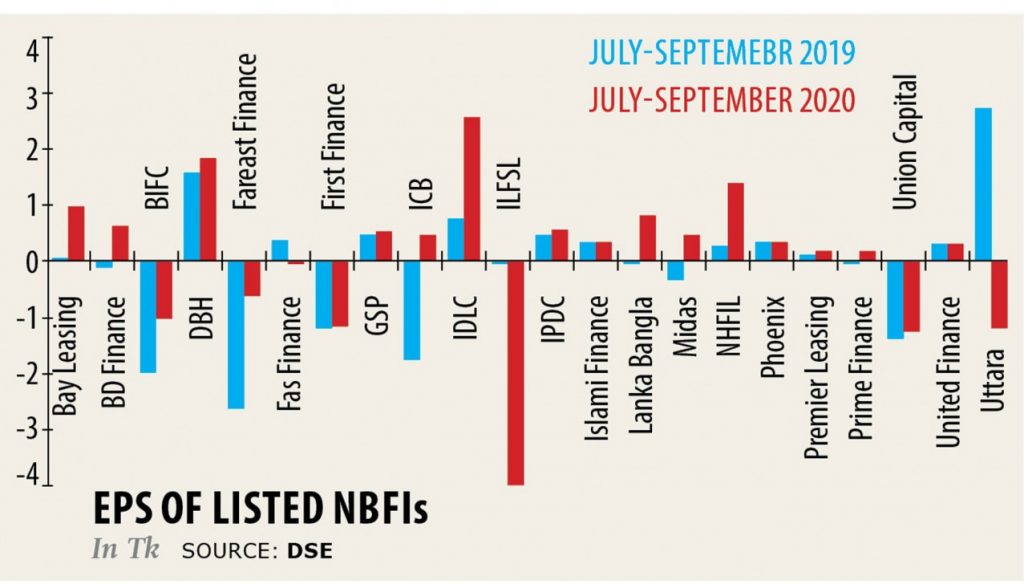

The NBFIs are Bangladesh Industrial Finance Company Ltd (BIFC), Fareast Finance & Investment Ltd, FAS Finance & Investment Ltd, First Finance Ltd, GSP Finance Company (Bangladesh) Ltd, Industrial & Infrastructure Development Finance Company Ltd, International Leasing & Financial Services Ltd, MIDAS Financing Ltd, National Finance Ltd, Premier Leasing & Finance Ltd, Prime Finance & Investment Ltd, Reliance Finance Ltd and Union Capital Ltd.

Recently another NBFI company, the Uttara Finance and Investments Ltd was involved in BDT 5,100 crore or EUR 510 mln scam.

The CAR is a ratio of capital of a financial institution as percentage of its risk-weighted assets and current liabilities. Regulators fix CAR to protect depositors’ money.

Industry insiders say following the BB order, many NBFIs would not be allowed to declare either cash or stock dividend for their shareholders for the year that ended on December 31 as their ratio of classified loans is high.

Non-performing loans at 33 NBFIs stood at BDT 8,905 crore or EUR 890.5 mln in June, which were 13.29 per cent of the outstanding loans, according to data from the central bank.

It was BDT 6,399 crore or EUR 640 mln or 9.5 per cent of the total loans as of December last year.

The central bank also barred the NBFIs with sound financial health from paying more than 15 per cent cash dividend in view of the challenges in the aftermath of the Covid-19 pandemic led wreckage in the economy.

-: END :-